简要介绍:

使用SKlearn和LinearRegression两种方法进行股价预测,最后对两种方法的结果进行对比。

一、安装sklearn

在网上查了一下,要安装sklearn,需要先安装scipy,

要安装scipy,需要先安装numpy+mkl,不过我在自己的电脑上测试一下,发现可以直接import sklearn,所以一切OK。

二、测试

1.代码出错

然后测试代码,打印几次之后,报错:

raise klass(message, resp.status_code, resp.text, resp.headers, code)

quandl.errors.quandl_error.LimitExceededError: (Status 429) (Quandl Error QELx01

) You have exceeded the anonymous user limit of 50 calls per day. To make more c

alls today, please register for a free Quandl account and then include your API

key with your requests.

好吧,我去注册账号吧,结果发现注册到step 3 of 3的时候,发现无法显示验证码,重新换一个浏览器也不行。

好吧,改用 米筐的数据吧,这一次发现自己找的代理可以使用https://www.2980.com来注册邮箱。这样就解决了以后注册米筐的问题。

好吧,这台电脑上好像又没装rqdata,继续改用joinquant,成功下载到了数据。

三、小知识

1.SVM(SVR)算法

是英文support vector machine的缩写,翻译成中文为支持向量机。它是一种分类算法,但是也可以做回归,根据输入的数据不同可做不同的模型(若输入标签为连续值则做回归,若输入标签为分类值则用SVC()做分类)

SVR(kernel='rbf', C=1e3, gamma=0.1)

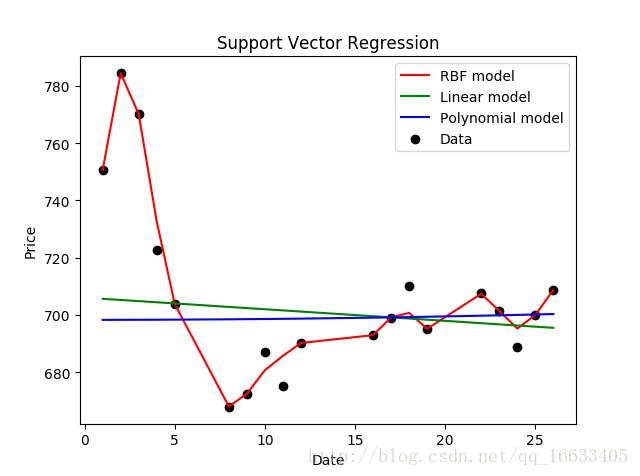

(1)kernel:核函数的类型,一般常用的有’rbf’,’linear’,’poly’,等如图4-1-2-1所示,发现使用rbf参数时函数模型的拟合效果最好。

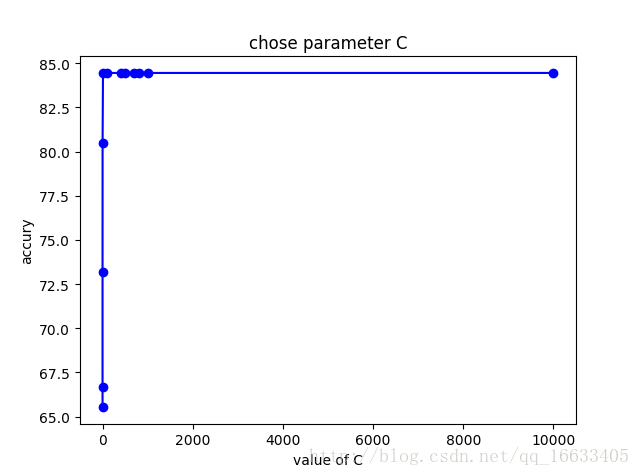

(2)C:惩罚因子。C表征你有多么重视离群点,C越大越重视,越不想丢掉它们。C值大时对误差分类的惩罚增大,C值小时对误差分类的惩罚减小。当C越大,趋近无穷的时候,表示不允许分类误差的存在,margin越小,容易过拟合;当C趋于0时,表示我们不再关注分类是否正确,只要求margin越大,容易欠拟合。如图4-1-2-2所示发现当使用1e3时最为适宜。

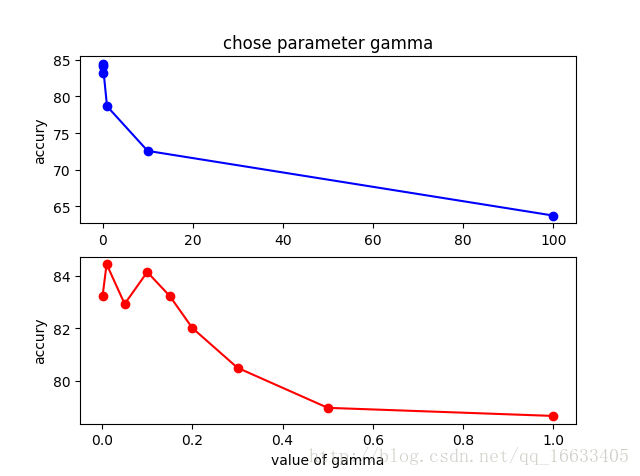

(3)gamma: 是’rbf’,’poly’和’sigmoid’的核系数且gamma的值必须大于0。随着gamma的增大,存在对于测试集分类效果差而对训练分类效果好的情况,并且容易泛化误差出现过拟合。如图4-1-2-3所示发现gamma=0.01时准确度最高。

可参考:https://blog.csdn.net/qq_16633405/article/details/70243030

四、源码:

import quandl

import numpy as np

from sklearn.linear_model import LinearRegression

from sklearn.svm import SVR

from sklearn.model_selection import train_test_split

#Get the stock data

# df = quandl.get("WIKI/AMZN")

# Take a look at the data

# print(df.head())

from jqdatasdk import *

auth('138xxxxxxx','a...4')

# quotes = pd.read_csv('002.csv') # 读取训练数据

stock_code = '601318.XSHG'

start_date = '2016-02-05'

end_date = '2017-02-07'

df = get_price(stock_code, start_date, end_date, frequency='daily',skip_paused=False,fq='pre',fields=['open','high','low','close','money'])

print(df.head())

df = df[['close']]

print(df.head())

# A variable for predicting 'n' days out into the future

forecast_out = 30 #'n=30' days

#Create another column (the target or dependent variable) shifted 'n' units up

df['Prediction'] = df[['close']].shift(-forecast_out)

#print the new data set

print(df.tail())

### Create the independent data set (X) #######

# Convert the dataframe to a numpy array

X = np.array(df.drop(['Prediction'],1))

#Remove the last 'n' rows

X = X[:-forecast_out]

# print(X)

### Create the dependent data set (y) #####

# Convert the dataframe to a numpy array (All of the values including the NaN's)

y = np.array(df['Prediction'])

# Get all of the y values except the last 'n' rows

y = y[:-forecast_out]

# print(y)

# Split the data into 80% training and 20% testing

x_train, x_test, y_train, y_test = train_test_split(X, y, test_size=0.2)

# Create and train the Support Vector Machine (Regressor)

svr_rbf = SVR(kernel='rbf', C=1e3, gamma=0.1)

svr_rbf.fit(x_train, y_train)

# Testing Model: Score returns the coefficient of determination R^2 of the prediction.

# The best possible score is 1.0

svm_confidence = svr_rbf.score(x_test, y_test)

print("svm confidence: ", svm_confidence)

# Create and train the Linear Regression Model

lr = LinearRegression()

# Train the model

lr.fit(x_train, y_train)

# Testing Model: Score returns the coefficient of determination R^2 of the prediction.

# The best possible score is 1.0

lr_confidence = lr.score(x_test, y_test)

print("lr confidence: ", lr_confidence)

# Set x_forecast equal to the last 30 rows of the original data set from Adj. Close column

x_forecast = np.array(df.drop(['Prediction'],1))[-forecast_out:]

# print(x_forecast)

# Print linear regression model predictions for the next 'n' days

lr_prediction = lr.predict(x_forecast)

print("linear regression model predictions for the next n days:\n",lr_prediction)

#将numpy数据存为csv

np.savetxt("lr_prediction.csv", lr_prediction, delimiter=',')

# Print support vector regressor model predictions for the next 'n' days

svm_prediction = svr_rbf.predict(x_forecast)

print("support vector regressor model predictions for the next n days:\n",svm_prediction)

#将numpy数据存为csv

np.savetxt("svm_prediction.csv", svm_prediction, delimiter=',')

#Original stock price

z = np.array(df['close'])

print("Original stock price for the next n days:\n",z[-forecast_out:])

np.savetxt("z.csv", z[-forecast_out:], delimiter=',')

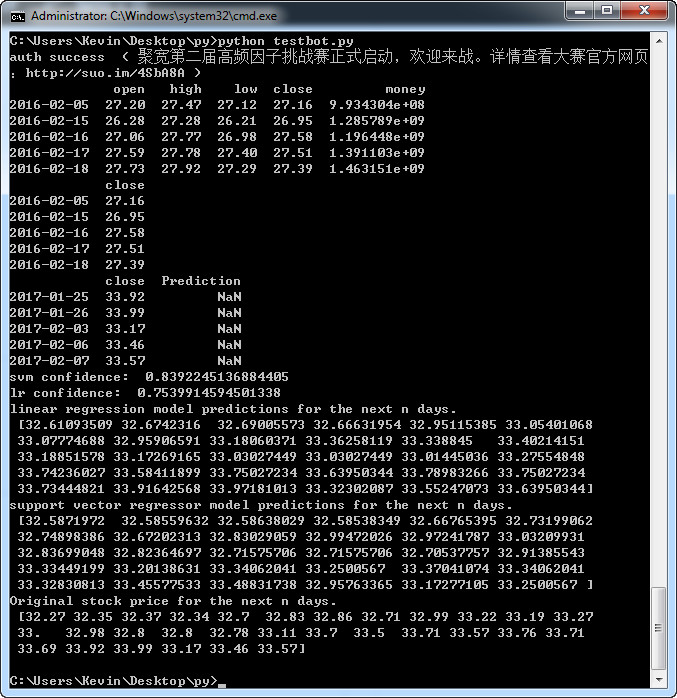

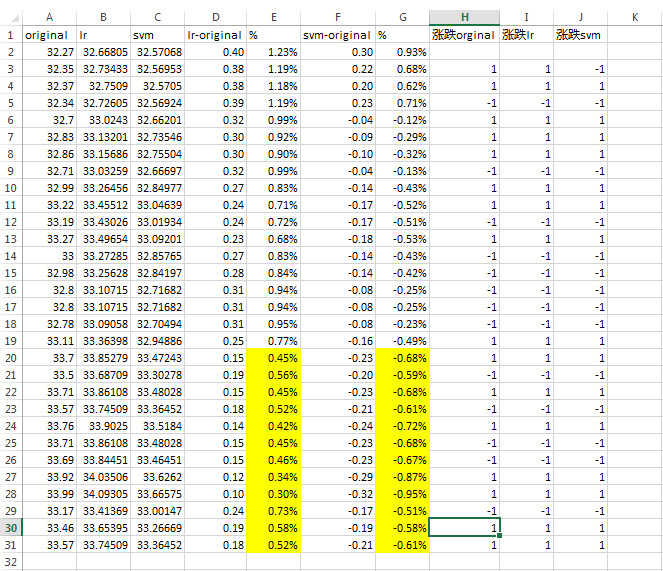

五、执行结果

https://www.youtube.com/watch?v=EYnC4ACIt2g&t=9s

六、分析

很明显,在执行“df['Prediction'] = df[['close']].shift(-forecast_out)”这句的时候,其实就是将未来30天的价格移到了现在,又去预测未来价格,使用了未来函数。

参考资料:

https://www.joinquant.com/view/community/detail/3f5f73ce173b157abac9aef8c0a71a96

https://www.youtube.com/watch?v=JgC9BEVS9Tk

https://www.youtube.com/watch?v=wxKLtaUryCw

https://www.youtube.com/watch?v=zwqwlR48ztQ