一、优矿

要登陆优矿,直接使用手机验证码登陆即可。

或者用账号:138+K134

二、效果

三、代码

from hmmlearn.hmm import GaussianHMM

import datetime

import numpy as np

from matplotlib import cm, pyplot as plt

import matplotlib.dates as dates

import pandas as pd

import seaborn as sns

sns.set_style('white')

beginDate = '20100401'

endDate = '20160317'

data = DataAPI.MktIdxdGet(ticker='000001',beginDate=beginDate,endDate=endDate,field=['tradeDate','closeIndex','lowestIndex','highestIndex','turnoverVol'],pandas="1")

data1 = DataAPI.FstTotalGet(exchangeCD=u"XSHE",beginDate=beginDate,endDate=endDate,field=['tradeVal'],pandas="1")

data2 = DataAPI.FstTotalGet(exchangeCD=u"XSHG",beginDate=beginDate,endDate=endDate,field=['tradeVal'],pandas="1")

tradeVal = data1 + data2

tradeDate = pd.to_datetime(data['tradeDate'][5:])

volume = data['turnoverVol'][5:]

closeIndex = data['closeIndex']

deltaIndex = np.log(np.array(data['highestIndex'])) - np.log(np.array(data['lowestIndex']))

deltaIndex = deltaIndex[5:]

logReturn1 = np.array(np.diff(np.log(closeIndex)))

logReturn1 = logReturn1[4:]

logReturn5 = np.log(np.array(closeIndex[5:])) - np.log(np.array(closeIndex[:-5]))

logReturnFst = np.array(np.diff(np.log(tradeVal['tradeVal'])))[4:]

closeIndex = closeIndex[5:]

X = np.column_stack([logReturn1,logReturn5,deltaIndex,volume,logReturnFst])

# Make an HMM instance and execute fit

model = GaussianHMM(n_components=6, covariance_type="diag", n_iter=1000).fit([X])

# Predict the optimal sequence of internal hidden state

hidden_states = model.predict(X)

#print("Transition matrix")

#print(model.transmat_)

#print()

#print("Means and vars of each hidden state")

#for i in range(model.n_components):

# print("{0}th hidden state".format(i))

# print("mean = ", model.means_[i])

# print("var = ", np.diag(model.covars_[i]))

#整合数据

res = pd.DataFrame({'tradeDate':tradeDate,'logReturn1':logReturn1,'logReturn5':logReturn5,'volume':volume,'state':hidden_states}).set_index('tradeDate')

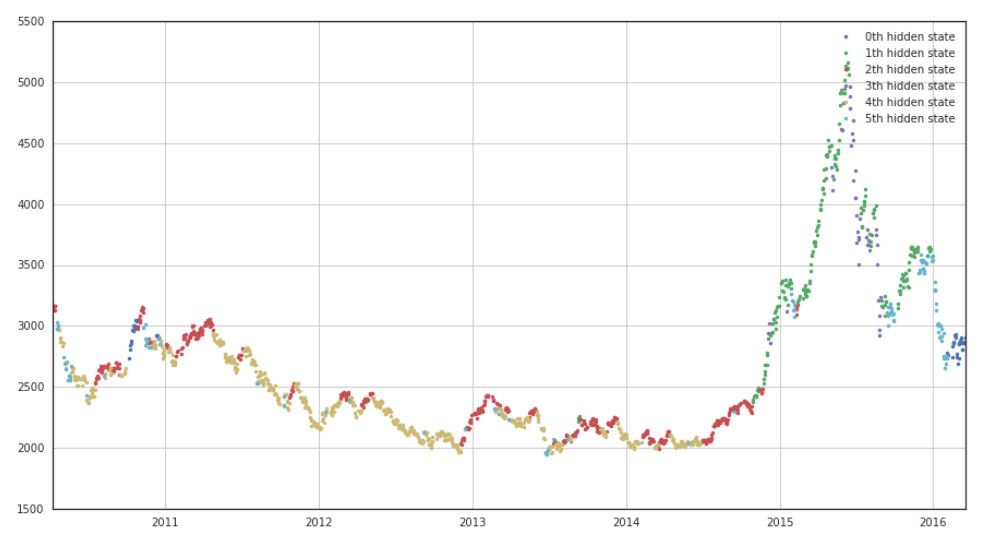

plt.figure(figsize=(15, 8))

for i in range(model.n_components):

idx = (hidden_states==i)

plt.plot_date(tradeDate[idx],closeIndex[idx],'.',label='%dth hidden state'%i,lw=1)

plt.legend()

plt.grid(1)

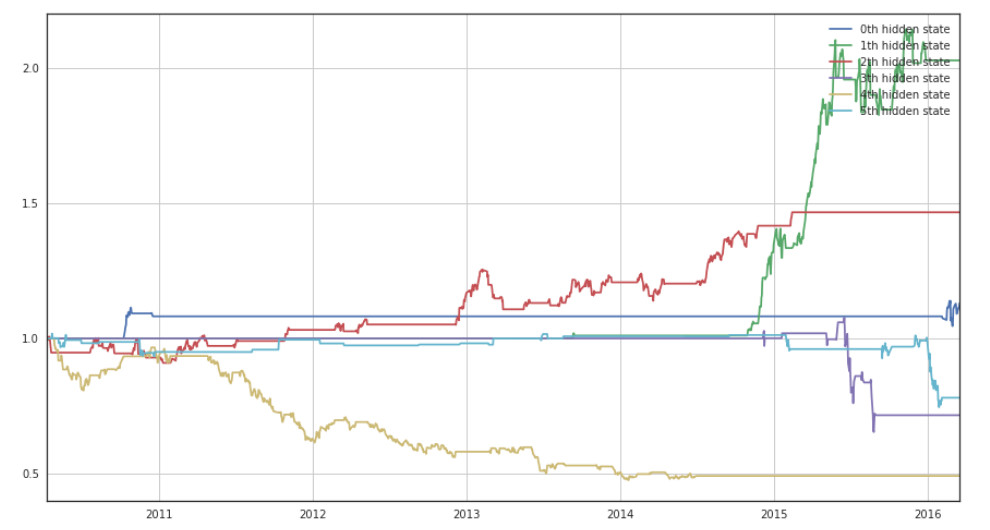

plt.figure(figsize=(15, 8))

for i in range(model.n_components):

idx = (hidden_states==i)

idx = np.append(0,idx[:-1])#获得状态结果后第二天进行买入操作

#fast factor backtest

df = res.logReturn1

res['sig_ret%s'%i] = df.multiply(idx,axis=0)

plt.plot(np.exp(res['sig_ret%s'%i].cumsum()),label='%dth hidden state'%i)

plt.legend()

plt.grid(1)

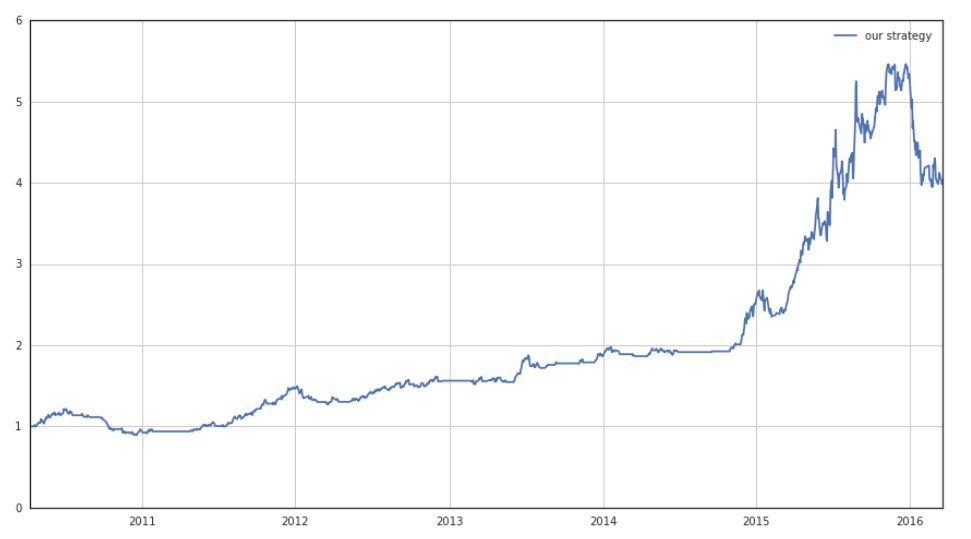

plt.figure(figsize=(15, 8))

idxlong = (hidden_states==1) + (hidden_states==5) #做多状态

idxlong = np.append(0,idxlong[:-1])#获得状态结果后第二天进行买入操作

idxshort = (hidden_states==0) + (hidden_states==3) + (hidden_states==4) #做空状态

idxshort = np.append(0,idxshort[:-1])#获得状态结果后第二天进行买入操作

#fast factor backtest

df = res.logReturn1

res['sig_retbest'] = df.multiply(idxlong,axis=0) - df.multiply(idxshort,axis=0)

plt.plot_date(tradeDate,np.exp(res['sig_retbest'].cumsum()),'-',label='our strategy')

plt.legend()

plt.grid(1)

参考:https://uqer.io/v3/community/share/56ec30bf228e5b887be50b35