今天花半小时试用了一下Backtrader,发现还真的挺简单的,而且发现它的回测结果展示挺炫酷的。

一、安装,直接用pip install backtrader

二、回测

1.成果展示(双均线)

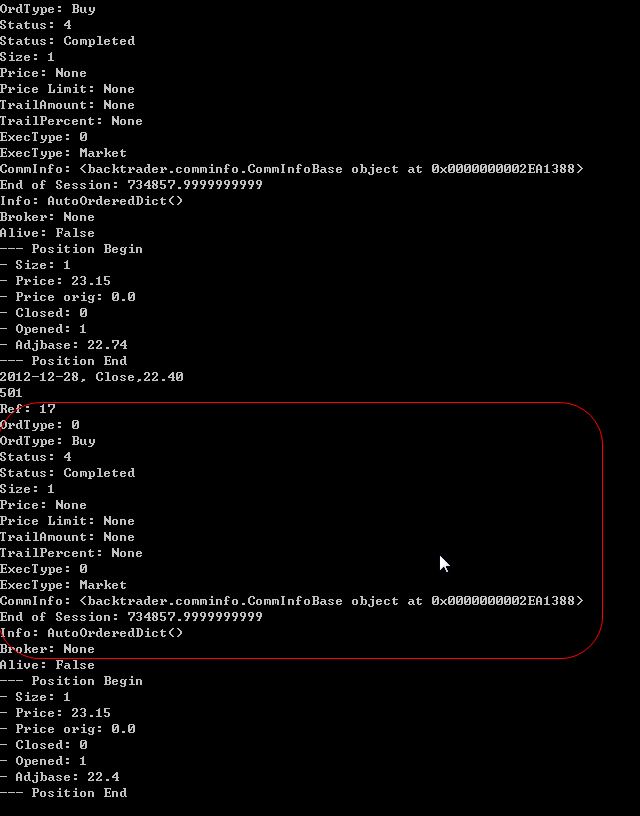

打印的内容:

2.代码

test.py

# from __future__ import (absolute_import, division, print_function,

# unicode_literals)

import backtrader as bt

import datetime

from strategy import SmaCross

cerebro = bt.Cerebro()

# Create a Data Feed

data = bt.feeds.YahooFinanceCSVData(

dataname="oracal.csv",

# Do not pass values before this date

fromdate=datetime.datetime(2000, 1, 1),

# Do not pass values after this date

todate=datetime.datetime(2000, 12, 31),

reverse=False)

# Add the Data Feed to Cerebro

cerebro.adddata(data)

cerebro.addstrategy(SmaCross)

# Set our desired cash start

cerebro.broker.setcash(100000.0)

print('Starting Portfolio Value: %.2f' % cerebro.broker.getvalue())

cerebro.run()

print('Final Portfolio Value: %.2f' % cerebro.broker.getvalue())

2.strategy.py

import backtrader as bt

from datetime import datetime

# Create a subclass of Strategy to define the indicators and logic

class SmaCross(bt.Strategy):

# list of parameters which are configurable for the strategy

params = dict(

pfast=10, # period for the fast moving average

pslow=30 # period for the slow moving average

)

def log(self, txt, dt=None):

''' Logging function for this strategy'''

dt = dt or self.datas[0].datetime.date(0)

print('%s, %s' % (dt.isoformat(), txt))

def __init__(self):

sma1 = bt.ind.SMA(period=self.p.pfast) # fast moving average

sma2 = bt.ind.SMA(period=self.p.pslow) # slow moving average

self.crossover = bt.ind.CrossOver(sma1, sma2) # crossover signal

self.dataclose = self.datas[0].close

self.order = None

def next(self):

self.log('Close,%.2f' % self.dataclose[0])

print(len(self))

print(self.order)

print(self.position)

if not self.position: # not in the market

if self.crossover > 0: # if fast crosses slow to the upside

self.order = self.buy() # enter long

self.log('-----buy, close price is: %.2f' % self.dataclose[0])

elif self.crossover < 0: # in the market & cross to the downside

self.order = self.close() # close long position

self.log('-----sell, close price is:%.2f' % self.dataclose[0])

cerebro = bt.Cerebro() # create a "Cerebro" engine instance

# Create a data feed

data = bt.feeds.YahooFinanceData(dataname='MSFT',

fromdate=datetime(2011, 1, 1),

todate=datetime(2012, 12, 31))

cerebro.adddata(data) # Add the data feed

cerebro.addstrategy(SmaCross) # Add the trading strategy

cerebro.run() # run it all

cerebro.plot() # and plot it with a single command

3.oracal.csv

Date,Open,High,Low,Close,Adj Close,Volume 1995-01-03,2.179012,2.191358,2.117284,2.117284,1.883304,36301200 1995-01-04,2.123457,2.148148,2.092592,2.135803,1.899776,46051600 1995-01-05,2.141975,2.148148,2.086420,2.092592,1.861340,37762800 1995-01-06,2.092592,2.154321,2.061728,2.117284,1.883304,41864400 1995-01-09,2.135803,2.179012,2.129630,2.179012,1.938211,34639200 1995-01-10,2.191358,2.216049,2.185185,2.185185,1.943701,42088000 1995-01-11,2.203704,2.216049,2.098765,2.120370,1.886049,46762000 1995-01-12,2.123457,2.129630,2.086420,2.104938,1.872322,41294400

参考:

oracal

https://www.youtube.com/watch?v=K8buXUxEfMc

https://www.backtrader.com/home/helloalgotrading/

运行代码出错的了??